In this article, I want to share the single best personal finance advice for people of color I have learned and how it changed my relationship with money and my mental health.

I will teach you what a financial runway is, how to calculate a proper financial runway, what a budget is, and where to find the money for your financial runway. Additionally, I will address why people of color lack financial stability, how we disregard our finances, and why this affects our mental health. So, if you are struggling to build a safety net, don’t know where to start, or find the money, this article is for you.

Suppose I were to tell you that you have two weeks before you lose your job, and there’s currently no prospect of you getting another opportunity.

How would you go to sleep tonight?

Chances are, it would turn your life upside down and ruin your night.

Well, in this article, I’m going to help you make sure that even if this unfortunate event were to happen, you still go to sleep like a baby, happy and at peace.

With this personal finance advice, I hope to help people of color build a solid financial foundation to have the confidence and freedom to make important decisions without losing sleep.

Financial Stability and Your Mental Health

When talking about mental health, the subject of finances might not be the first thing to come to mind.

But the reality is that, in 2022, financial instability is the norm. And for those of us who don’t have the privilege to see money as a certainty, this is one of the most insidious sources of anxiety, stress, and lack of sleep.

For people of color like me, achieving financial stability is always at the top of our laundry list. Heck, getting a steady and sufficient source of income is quite an achievement if you look at the statistics.

Racial Gap in Financial Literacy

You might hear people say that millennials and gen-z have it hard in this economy. That they are laboring like no other generation. But I would argue that millennials and gen-z of color are the ones facing the brunt of the struggle to secure any form of financial stability.

This situation is, of course, wreaking havoc on our mental health and our capacity to function as adults.

We are working more than any other generation or group. Yet, we struggle to keep our jobs and are hesitant to make decisions that could improve our lives, like asking for promotions or leaving a job to pursue a dream. All because we have no solid foundation or safety net to rely on.

And yet, for most of you reading this, the idea of a financial runway might be entirely foreign or even unknown.

The Single Best Personal Finance Advice for People of Color

So, what is a financial runway anyway? And why am I talking about it?

Well, if you knew what it was, and better yet, had one, you would not be affected by all the problems I just described.

You would be part of the lucky few who have the liberty and peace of mind to choose what dreams to pursue and what to put up with, regardless of wealth or privilege. All without stressing about how you’re going to put food on the table.

I want you to have that. I want you to have a solid foundation that gives you confidence and freedom to topple anything you have built and start again without rocking your life. And you would be surprised at how little it actually takes to have it.

You just have to be willing to take control of your lifestyle and set yourself up for success.

What is a Financial Runway?

Alright, so let’s address the big question.

A financial runway is a specific amount of money put away to be used in the event that you lose your job, have an unexpected emergency, or have any disruption of your income.

You might be thinking “Wait, Isn’t that just savings?”

And the answer is yes. But a financial runway has a specific purpose.

It exists to supplement or replace your income so that you can keep fulfilling your most critical responsibilities for a finite period of time.

In essence, a financial runway is a safety net to catch you and give you time to get yourself back on track.

Why is Financial Literacy Important for People of Color?

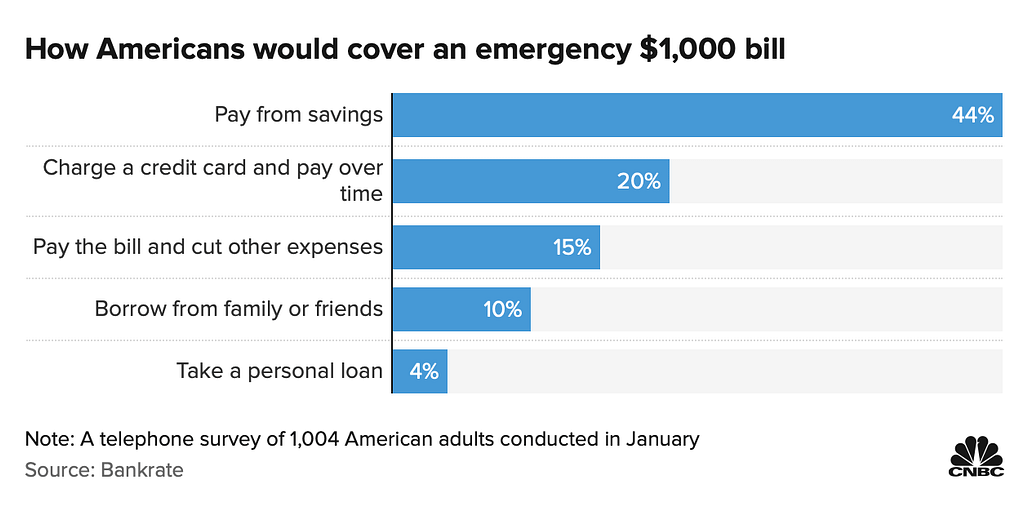

This last point is crucial because most Americans don’t have enough savings to last one month without a paycheck.

And many don’t even understand the tricky situation they live in.

I have heard people say things like:

- “I dunno. I get money, and then I spend it.”

- “I’m not going to lose my job. I’m indispensable.”

- “I don’t want to know how much I’m spending.”

- “Money comes in; money goes out. That is life.”

This way of thinking is a privilege that we, as people of color, American or not, can’t afford. And quite honestly, whether you are privileged or not, you should not think of your current situation as a certainty.

Are you on board yet?

Alright, let’s talk details.

How to Build a Financial Runway?

A reasonable financial runway period (in my opinion) would be around six months of expenses. However, three months could be sufficient for young people with few responsibilities to get back on their feet.

And when I say expenses, I’m not talking about your Netflix subscription or your regular visits to the bar. I’m talking bare minimum, keep the roof and something on the table, kind of expenses. So don’t factor in your salon visits and fancy nights out.

Good? Alright.

Once you know what period you can tolerate and how much your essential expenses amount to, you can easily determine how much money your runway would have. For example, having a monthly expense of $2,500 for a financial runway of 6 months would amount to $15,000.

Now, I know that is a lot of money, and I can’t expect everyone to be able to save that much, especially in difficult times like these, but don’t let it intimidate you. Making this happen is totally possible, even with the tightest budget.

Budgetting: The Swiss Army Knife of Personal Finances

I know that for many of you, the idea of budgeting might be intimidating or even triggering. And I understand that maybe you don’t want to know how much you’re spending on streaming services and food delivery.

But you need to realize that, in this case, blissful ignorance is quite dangerous to your financial and mental stability.

As much as it scares you to see a long laundry list of frivolous expenses, you should take steps towards having your life and finances in order. And in order to do that, you’re going to need all the tools available to you.

Budgeting happens to be the best of them.

Budgeting is a tool that reveals the reality of your financial life and helps you make informed decisions. It’s literally setting yourself up for success.

Additionally, budgeting allows you to make adjustments that would enable you to buy stuff that otherwise would be outside of your means or too disruptive to your wallet.

For many people of color like me, who have adopted a more frugal and restrained lifestyle due to necessity, budgeting is like breathing. Without it, I would not be where I am now.

If you want to know more about creating a budget that will give you back control over your finances and mental health, let me know in the comments down below, and I will make a separate article about it.

Where to Find the Money for a Financial Runway?

Now, how do you save $15,000? Well, there are two paths, really. Either you reduce your expenses or increase your income. And for many of you, the easiest way to find this money is by taking the first path. This means that you have to adapt your lifestyle to fit within your means.

However, I don’t want you to completely discard the option of increasing your income by doing side jobs or negotiating your salary.

This approach might be risky and demanding, especially for the people struggling to make ends meet; The ones that happen to really need to build that financial runway the most. But, I believe it’s important to keep that option on the table, especially if you are young and have spare time.

Now, here are some practical ways to have more control over your finances and reduce your expenses.

- Create a monthly budget and stick to it.

- Adjust your lifestyle to always be within your means or below.

- Set your bank account to make automatic transfers to a secondary savings account.

My Personal Finance Advice for People of Color that Works

Personally, I built my financial runway mainly by using the last tactic. I set up an automatic monthly withdrawal from my earnings account into a separate account. That account had no convenient or straightforward way for me to access the funds; No credit or cash card to touch that money.

And is that extra friction, compounded with the hands-off, automatic nature of the withdrawal, that made it really hard for me to touch that money.

So I eventually forgot that the withdrawal was even happening.

I adjusted my lifestyle to fit within the income left and carried on with my life. All while my safety net was silently being built on its own.

The Long Road to a Solid Financial Foundation

Now, I know that saving $15,000 might seem very difficult to you; It took me a while to get there. But the most crucial factor that helped me stay consistent and succeed was knowing that I wasn’t supposed to have that money saved in a month or even a year.

Yes, you can calculate to build a financial runway in two years, save monthly, and not disrupt your lifestyle much at all.

In the end, it took me 14 months to build my financial runway, and during that time, there was little change in my lifestyle. I was just carrying on with my life, focusing on the day-to-day.

Finally, don’t overdo it.

A financial runway should only be of a specific amount and should not grow with your lifestyle or income. Don’t let it become an obsession with controlling what we can’t control.

Remember, too much runway will take too much from your life. But too little runway is a risky gamble that will inevitably ruin you.

Being responsible is necessary for living. Being frugal is a waste of life.

Freedom to Pursue Your Goals

Whether you are a person of color or not, you need to understand the basics of financial responsibility and money management. Once you do, you can build a path to achieve financial independence and be free to leave a bad job, survive any emergency, or pursue a dream career.

So build that runway, and give yourself the freedom to say f*ck you to anything you don’t want. That way, you can go to bed in peace, no matter what scenario play out.

I also want to encourage you to consider tools like OfColor, a great financial wealth platform with fantastic resources for people of color struggling with the trappings of finance in the 21st century.

Cover photo by Annie Spratt on Unsplash